You need to calculate the sales made in credit to the customers and deduct the trade discount, if any, allowed to the customer.

AVERAGE ACCOUNTS RECEIVABLE FORMULA PLUS

From the Profit & Loss A/c, you can find the company's total sales (cash plus credit) made in a given period. You can determine net credit sales from the Income statement or Profit and Loss Account.To calculate this ratio with the help of formula first, you need to determine its components, namely, net credit sales and average trade debtors:

AVERAGE ACCOUNTS RECEIVABLE FORMULA HOW TO

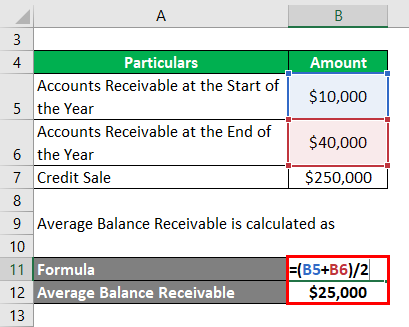

Now that you know the meaning o f debtors turnover ratio, let us know how to calculate debtors turnover ratio. Note that debtors include the amount due from the customers and bills receivables. Average trade debtors or receivables = (Opening balance of debtors + Closing balance of debtors)/2 Net Credit Sales = Total or Gross Credit Sales (-) Sales return (-) Trade discount.Ģ. Net credit sale is the total sales made to the customers on a credit basis minus the sales returned by the customers and trade discounts, if any, allowed to them. What is the debtors turnover ratio formula?ĭebtors turnover ratio is calculated with the help of the following formula:ĭebtors or Trade Receivables Turnover Ratio = Net Credit Sales / Average Trade Debtors or Receivablesġ. The debtors turnover ratio is also known as the trade receivables turnover ratio, a financial analysis tool to calculate the number of times the average debtors are converted into cash during the year. Due to the sale of goods on credit, there may be a delay in payments, and hence, the money receivable is known as accounts receivable. When sales are made in credit, the other party who owes money (to be paid later) is known as the debtor. In business, sales are made in cash as well as credit. Learn these aspects in detail in this article. In this regard, the account receivable turnover ratio measures the speed and efficiency of collecting money for the sales made in credit.

Turnover ratios are also known as efficiency ratios, as these are calculated to determine the efficiency of managing and utilising current assets. Turnover ratios are calculated to determine how the number of assets and liabilities are created or exchanged in relation to a company's sales. Various ratios are calculated for analysis of financial information, among which turnover ratio is a crucial one.

0 kommentar(er)

0 kommentar(er)